In many countries, a uniform tax structure like VAT (Value-Added Tax) simplifies transactions and compliance, particularly for international trade. In contrast, the U.S. relies on a Sales Tax system, which can confuse businesses exporting to the U.S. Businesses planning to engage in international trade may benefit from considering how tax systems could impact their operations, particularly in managing cross-border payments and ensuring compliance.

In this blog, we’ll discuss the differences between VAT and U.S. sales tax and how they reflect distinct approaches to taxation impacting businesses, consumers, and the global economy.

What is VAT?

VAT stands for Value Added Tax, a consumption tax levied on the value added at each stage of production or distribution of goods and services. It is a type of indirect tax, meaning consumers do not directly pay it to the government but instead collect it from businesses at the point of sale and then pass it on to the government.

It is transparent, as it is clearly reflected in invoices at each stage of the supply chain. Businesses charge VAT on their sales, known as output VAT, and can claim back VAT paid on their purchases, referred to as input VAT. This ensures that only the value added at each stage is taxed. Ultimately, the final consumer bears the cost of the tax.

What is U.S. Sales Tax?

U.S. Sales Tax is a consumption tax imposed by state and local governments on the sale of goods and certain services. Unlike VAT, which is applied at every stage of production and distribution, U.S. sales tax is a single-stage tax used only at the point of sale to the end consumer.

Businesses collect the tax at the point of sale and remit it to state or local authorities. Unlike VAT, sales tax is not charged on intermediate transactions, making it more straightforward for businesses in the supply chain. Rates vary widely across states, cities, or localities, typically ranging from 2% to 10%. Certain goods and services, such as groceries or medicines, may be exempt depending on state laws.

Also Read:Section 44ADA - Presumptive Tax Scheme for Professionals

This introduction provided a brief overview of VAT and U.S. sales Tax. Let’s move on to a more elaborate section to get a better understanding of the differences between the two:

Core Differences between VAT and U.S. Sales Tax

Differentiating between VAT and U.S. Sales Tax is crucial for exporters to develop effective pricing strategies and ensure compliance. VAT-inclusive pricing can influence how your products are perceived internationally, while the varying rates of U.S. Sales Tax add complexity. Exporters may also need to register for VAT in foreign countries if their sales exceed a threshold, while sales tax compliance requires detailed knowledge of local regulations.

Countries with VAT systems often exempt exports, making products more competitive abroad, whereas navigating local tax laws in the U.S. is essential to avoid penalties. Proper tax planning helps businesses meet regulations and avoid errors.

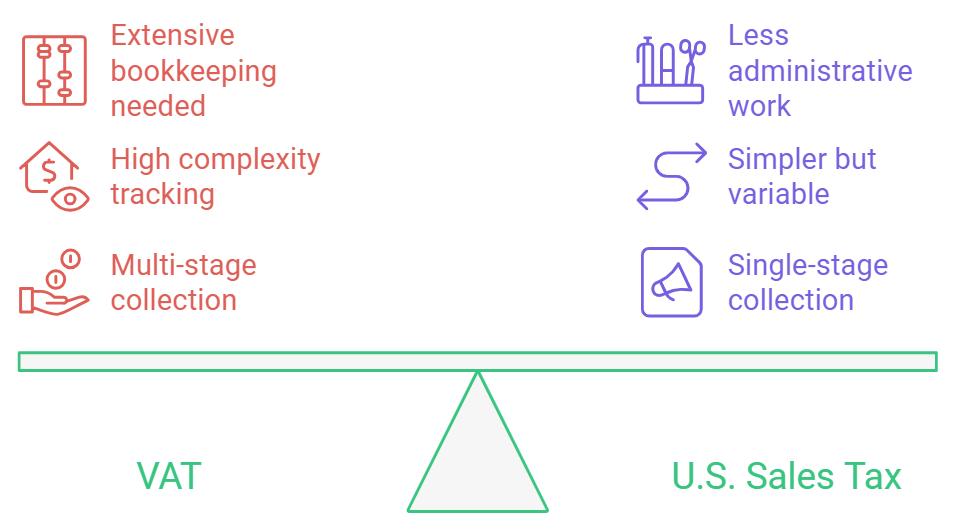

Image Source: Napkin.ai

Point of Collection

VAT is a multi-stage consumption tax added at each production phase, with businesses collecting VAT on sales and reclaiming credits on VAT paid to suppliers.

In contrast, the U.S. sales tax is typically a single-stage tax applied only at the final consumer sale, though some states may tax wholesale. This simpler one-time collection shifts the tax burden solely to the end consumer.

Complexity in Collection

VAT collection is inherently complex due to its multi-stage nature. It requires businesses to calculate input and output VAT, ensuring taxes are only paid on the 'value added' at each stage.

In contrast, sales tax is collected by retailers alone, making it simpler in theory, though complex in execution due to variations across states.

Economic Impact Differences

VAT and sales tax shape business operations and pricing in different ways. VAT incentivizes structured record-keeping as businesses track VAT credits and liabilities across each production stage. For instance, in the European Union, companies align operations to comply with VAT requirements to avoid penalties.

U.S. sales tax, meanwhile, influences pricing differently, as retailers add a flat percentage to the final price without intricate calculations at each stage.

Regressivity

VAT is often critiqued for being regressive, disproportionately impacting lower-income consumers since everyone pays the same rate regardless of income. However, some countries address this through exemptions or reduced rates on necessities.

The U.S. sales tax system, in comparison, has limited mechanisms to mitigate regressive impacts, though exemptions for groceries and medicine in many states partially address this issue. Here’s a detailed breakdown explaining the differences:

| Aspect | VAT (Value-Added Tax) | U.S. Sales Tax |

|---|---|---|

| Point of Collection | Collected at multiple stages | Collected only at the point of sale |

| Complexity | High, requires detailed tracking | Simpler but varies by state |

| Economic Impact | Requires extensive bookkeeping | Simpler with less administrative work |

| Regressivity | Mitigated in some cases with exemptions | Limited exemptions, often regressive |

With the core differences identified, let us look into how both these tax systems impact businesses:

Economic Impact on Businesses

If the U.S. adopts VAT, businesses could face significant economic impacts, such as increased administrative complexity due to multi-stage tax collection and the need for better compliance mechanisms, which could raise operational costs. In contrast, the current sales tax system in the U.S. is simpler for businesses, as it is only applied at the final sale, reducing compliance burdens but potentially leading to more price fluctuations across different states.

Under VAT, businesses act as agents of the government, collecting VAT at each production stage and remitting it. This approach shifts responsibility to businesses but also integrates tax collection directly into the production cycle. Companies in the EU, for instance, must maintain precise records and undergo regular audits to ensure accurate VAT payments.

The VAT system necessitates comprehensive bookkeeping, as businesses meticulously track both input and output VAT. By comparison, the simpler U.S. sales tax system requires fewer record-keeping adjustments. For a multinational company, adapting to VAT requires sophisticated accounting software to manage VAT payments across different regions.

Implementing VAT in a country like the U.S. would require businesses to adopt new administrative practices. For instance, managing compliance across state lines would become a significant challenge as VAT involves unified federal oversight, while sales tax varies by state. This shift would place a considerable administrative burden on businesses already accustomed to U.S. sales tax structures.

Also Read: Guide to International Money Transfer for Indian Businesses.

Having realized the economic impact of these tax systems, let’s understand various consumer implications:

Impact of Taxation on Consumers: VAT vs U.S. Sales Tax

In the U.S., consumers pay sales tax only at the final point of sale, unlike VAT’s multi-stage tax, often resulting in lower upfront prices but varied rates based on state policies. For businesses, this single-point sales tax simplifies pricing by avoiding cumulative taxes across production stages. However, they still face challenges in handling diverse state and local tax rates, which can complicate compliance and pricing consistency.

Let’s dig deeper into the implications while comparing both perspectives:

| Aspect | Consumer Perspective | Business Perspective |

|---|---|---|

| Tax Burden | In VAT systems, consumers bear the tax burden indirectly, as VAT is applied at each production phase. For instance, Germany’s 19% VAT adds up at every stage, increasing the final price. | In VAT systems, businesses reclaim taxes on inputs along the production chain, passing the cumulative VAT to consumers. U.S. businesses, however, collect sales tax only at the final sale, avoiding multi-stage taxation complexities. |

| Price and Transparency Impact | Consumers in VAT-based systems often face higher prices because VAT is embedded across the production chain, while U.S. sales tax is applied only at the final purchase, making U.S. prices seem more transparent. | The U.S. sales tax model allows businesses to price goods with fewer embedded taxes, which aids in transparency. In VAT countries, cumulative tax buildup results in higher prices, while U.S. sales tax is visible only at the final checkout. |

With this realization of consumer implications that both tax systems have, it’s time to analyze how VAT is globally accepted:

Global Adoption of VAT

The idea of implementing VAT in the U.S. has been debated for decades, driven by dissatisfaction with the current federal tax system. VAT could simplify tax collection and reduce deficits, making things easier for international businesses operating in the U.S. Despite that, the shift to VAT in the U.S. remains contentious due to economic and political factors:

VAT has been adopted by over 170 countries, making it the global standard outside the U.S. states. VAT or VAT-like systems are standard. The reasons vary: VAT is generally seen as efficient, reduces tax evasion at the final sale stage, and generates consistent revenue for governments. Implementation of VAT could lead to easier bookkeeping for your business in the U.S.

In certain jurisdictions, VAT is called GST (Goods and Services Tax) and reflects regional adaptations. India, for instance, uses GST, a VAT-like system that collects taxes at every transaction stage but is adapted to Canadian regulatory preferences. If VAT is implemented, businesses operating from India can have a uniform approach to pricing and taxes.

Also Read: Impact of GST on Indian Exports

Now that we have covered the possibility and future of VAT, let’s see how the future looks with the proposed changes:

What Will the Future Look Like with VAT?

Proposed changes in the U.S. tax system are centered on considerations like making the 2017 tax cuts permanent, reducing corporate tax rates, and simplifying tax compliance for small businesses. However, these assumptions depend heavily on legislative approval and balancing potential revenue losses with economic growth goals:

Competitive Pricing

VAT would allow your business to price products without the hidden inclusion of sales tax. Making it more straightforward to compete on pricing.

International Trade Impacts

Adopting VAT could have wide-reaching implications for U.S. trade relationships. For exporters, a VAT system could align U.S. practices with those of trade partners, simplifying cross-border transactions.

Potential for Revenue Consistency

VAT provides consistent revenue since it is collected throughout the supply chain rather than depending solely on consumer purchases. For businesses, the adoption of VAT could help create a more uniform formula for taxation.

With these futuristic assumptions, we must ensure businesses are compliant with the regulatory requirements to stay competitive:

Compliance and Administrative Aspects

VAT is typically federally administered with a uniform rate across regions, simplifying compliance for your business.

VAT Registration Requirements

Businesses in a VAT system must register with tax authorities, even if they do not engage in direct sales to consumers. In comparison, U.S. sales tax registration is simpler and typically limited to businesses selling directly to consumers within certain states. This will add another level of paperwork for B2B businesses but won’t change much for B2C businesses.

Compliance Obligations and Penalties

VAT compliance is rigorous, with significant penalties for non-compliance. While their intricacy varies by state, sales tax compliance can also be burdensome depending on jurisdiction. Businesses must ensure accurate VAT calculations, maintain records, and remit taxes periodically.

Here’s a breakdown explaining the differences between various compliance requirements:

| Aspect | VAT | U.S. Sales Tax |

|---|---|---|

| Registration Requirements | Mandatory for all stages | Primarily for consumer-facing businesses |

| Compliance Complexity | High, due to multi-stage requirements | Simpler, single-stage |

| Penalties | Often severe for incorrect reporting | Generally less severe |

Furthermore, implementing VAT in the U.S. could also increase federal oversight, potentially complicating business reporting requirements.

With this clear understanding of VAT and U.S. state tax systems—and why the U.S. hasn’t adopted VAT—you can now plan your business’s international reach without any doubts!

Conclusion

The differences between VAT and U.S. sales tax reflect fundamental contrasts in taxation philosophies. While VAT offers a revenue-stable, multi-stage approach widely adopted globally making it easier for businesses to compete in pricing, the U.S. has chosen a simpler, consumer-based sales tax, making a simpler filling process for importers.

While we don’t know the future of VAT in the U.S., you can still plan your global game with PayGlocal’s smarter payment solutions—ideal for a global business triumph! Maximize your potential with PayGlocal's cutting-edge payment solutions—designed to simplify cross-border transactions and keep your business ahead of the game! We offer you multi-currency accounts with a dynamic checkout and a seamless process for managing card payments and recurring payments effortlessly all from one platform. Enjoy fraud-detection technology and built-in sanction screening to secure your cross-border commerce with global payment methods. Visit PayGlocal today!